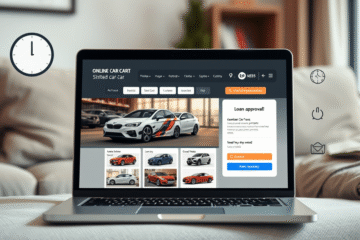

Fast Online Financing for Used Cars Today

Online Financing has revolutionized the way we shop for used cars, making the process more accessible and efficient than ever before. In this article, we will explore the seamless digital purchasing process that allows you to select your ideal vehicle, view personalized payment estimates, and receive immediate loan approvals—all from Read more…