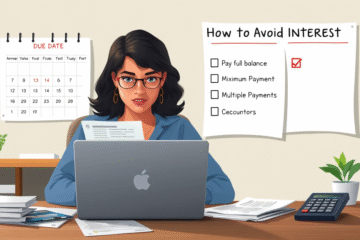

Rebuild Your Credit with a CA$1,000 Card Option

Bad Credit can feel like a significant barrier to achieving financial stability, but a credit card designed for individuals with poor credit can be a valuable tool for rebuilding your credit history. Get the credit card that fits your lifestyle!Start building your financial future today! In this article, we will Read more…