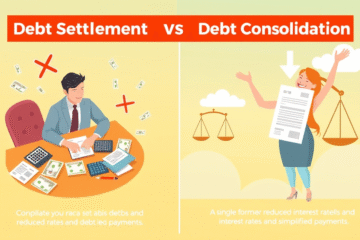

Manage Your Debt with Settlement and Consolidation

Debt Settlement and consolidation are crucial strategies for those facing financial challenges. In this article, we will explore the differences between these two approaches to managing debt, examining how each can provide relief and support in regaining financial control. Understanding the benefits and drawbacks of Debt Settlement and Debt Consolidation Read more…